5x Debate Proposal Rules:

(Purpose – so that not only the participants would ‘ideally’ sharpen each other, but also untold others could review the high quality debate by internet for many years to come.)

Rule:

- The topic be singular. (Single topic as much as possible.)

- The one bringing the presupposition* (presenter) has the floor for the 1st five minutes.

- The opposition then has the floor for the 2nd five minutes.

- The third round the floor is reversed and the opposition goes first and has the floor for the 3rd five minutes.

- The presenter then follows having the floor for the 4th five minutes.

- And the cycle repeated up to as many times as the two participants feel the need for, or have agreed to before the debate began. If both do not vote for additional time than was first agreed, both will then have ten minutes for a closing argument, of which is submitted without hearing the opponents closing arguments.

- If any party believes he was misrepresented in the closing argument he can request a impartial board of three people to vote (by majority) for an additional five minutes for each party.

The respondent has 7 days to submit a response.

Responses can be sent by the following:

i. Audio,

- Video,

- Text that will then be converted to text/reader-audio*,

- Tentatively we wish to keep debates on minor subject to 20 minutes, and difficult subject to only 60 minutes.

- All x5 Debates will be available on line perpetually at no cost, with a topical search capacity.

text/reader-audio* – All participants will have access to load there text into a internet reader to assure that all words are accurately converted to the audio format. (We are making the final product in audio format because of its high demand in our society, simply put, people are much more likely to listen than reading.

The beauty of this process is the participants can call on as many resources they wish to give a well sourced, thought out, professional response.

Information used to support any position of any issue is strongly recommended that it be sourced in a texted addendum that will accompany the final product. (Simply reference a paragraph number during the presentment and observers can reference the source in their leisure.

Terms Defined:

presupposition* – noun – a thing tacitly assumed (presented) beforehand at the beginning of a line of argument or course of action.

text/reader-audio* –

CLICK > HERE – Possible debatable issues of interest.

The below is the shortened URL link to this page –

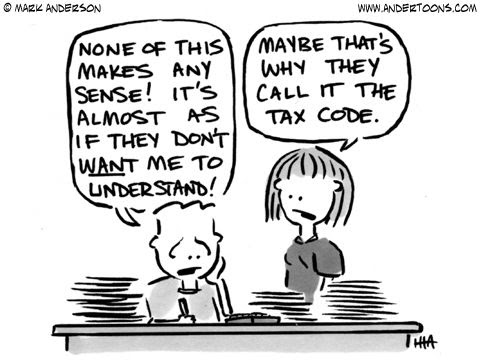

income may be made taxable because corporations are the product of state or federal law.

income may be made taxable because corporations are the product of state or federal law.